vermont income tax rate 2020

Tax Year 2020 Personal Income Tax - VT Rate Schedules. Rate Schedules 2020 2020 Vermont Rate Schedules.

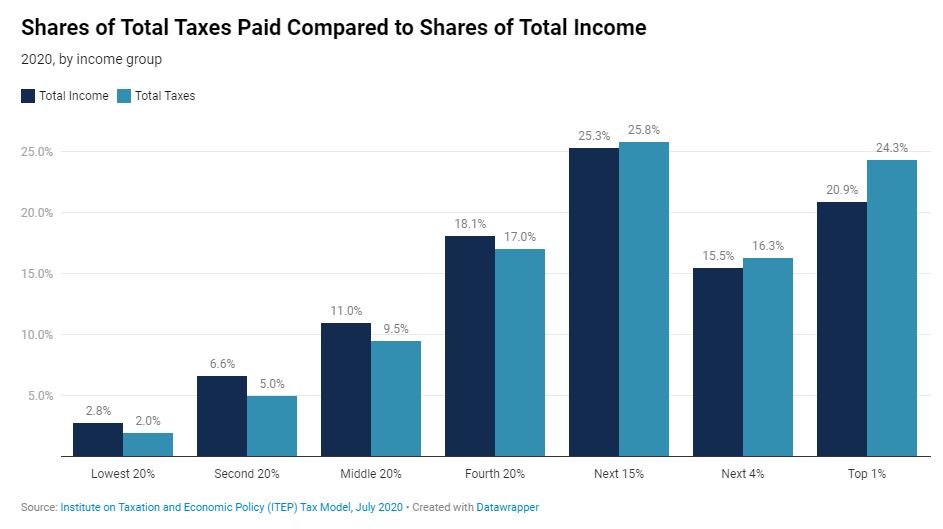

Who Pays Taxes In America In 2020 Itep

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

. 2019 VT Rate Schedules. Tax Rate Filing Status Income Range Taxes Due 335 Single 0 to 40350 335 of Income MFS 0 to 33725. The chart below breaks down the Vermont tax brackets using this model.

Add this amount 462 to Base Tax 2758 for Vermont Tax of 3220. Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table 1.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. There are no local taxes so all of your employees will pay the same state income tax no matter where they live. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017.

Enter 3220 on Form IN-111 Line 8. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Employees who make 204001 or more will hit the highest tax bracket.

Beginning January 1 2020 the estate tax exclusion rises from 275 million to 425 million. Check the 2020 Vermont state tax rate and the rules to calculate state income tax 5. Monday February 8 2021 - 1200.

Multiply the result 7000 by 66. Find your gross income 4. There are a total of eleven states with higher marginal corporate income tax rates then Vermont.

If youre a single filer with 40950 or below in annual taxable income youll pay the lowest state. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 3960000 youll pay 335 For earnings between 3960000 and 9600000 youll pay 66 plus 132660 For earnings between 9600000 and 20020000 youll pay 76 plus 504900. BA-402 2020 Instructions 2020.

Find your pretax deductions including 401K flexible account contributions. The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers making more than 251950 in taxable income. 2020 Vermont Tax Deduction Amounts.

Corporate and Business Income. 11 - Vermont Business Tax What is. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes. PR-141 HI-144 2020 Instructions 2020 Renter Rebate Claim. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Filing Status is Married Filing Jointly. Tax Rates and Charts. Relative to current law raising the exclusion is expected to have no fiscal impact FY2020.

2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Vermont charges a progressive income tax broken down into four tax brackets. 2019 VT Tax Tables.

Base Tax is 2758. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. On January 1 2021 the exclusion rises to 5 million.

Subtract 75000 from 82000. 2020 VT Tax Tables. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875.

Detailed Vermont state income tax rates and brackets are available on this page. RateSched-2020pdf 11722 KB File. Vermont Income Tax Rate 2020 - 2021.

If youre married filing taxes jointly theres a tax rate of 335 from 0 to 67450. The 2022 tax rates range from 335 on the low end to 875 on the high end. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married. Find your income exemptions 2. LC-142 2020 Instructions 2020 File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont State And Local Taxes. Tax Tables 2020 2020 Vermont Tax Tables.

2020 Vermont Tax Rate Schedules ExampleVT Taxable Income is 82000 Form IN-111 Line 7. The Vermont State Tax Tables below are a snapshot of the tax rates and thresholds in Vermont they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Vermont Department of Revenue website. Vermont also has a 600 percent to 85 percent corporate income tax rate.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. Meanwhile total state and local sales taxes.

Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is important to pay your state unemployment taxes on time. Smaller text bigger text download view download file print. The Vermont Married Filing Jointly filing status tax brackets are shown in the table below.

Total US government revenue for 2020 is 679 trillion including 342 trillion federal 188 trillion state and 149 trillion local. 2020 Income Tax Withholding Instructions Tables and Charts. Revenue Change Revenue Pie Chart.

What Are Tax And Expenditure Limits Tax Policy Center

States With Highest And Lowest Sales Tax Rates

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Percentage Of Forest Cover In Each Us State Usa

Here S The Average Irs Tax Refund Amount By State

Which States Pay The Most Federal Taxes Moneyrates

Who Pays Taxes In America In 2020 Itep

Where Carbon Is Taxed Overview

Where Carbon Is Taxed Overview

Federal Income Tax Rates For 2019 2020 H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

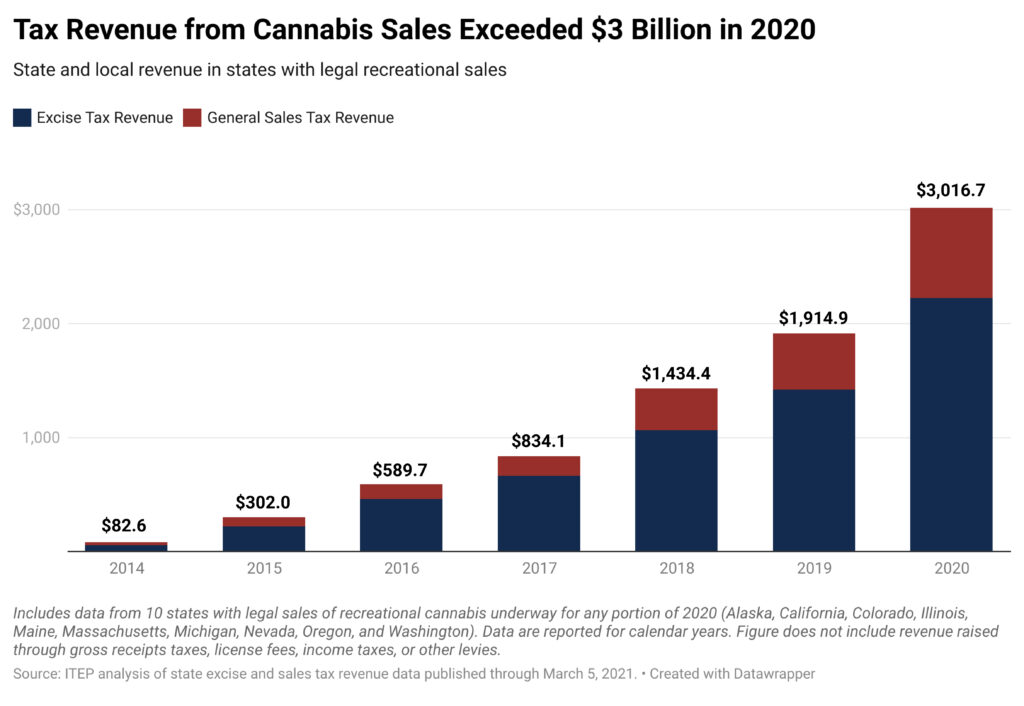

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

Taxes 2020 These Are The States With The Highest And Lowest Taxes

Tax Foundation On Twitter South Dakota Inbound Map

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design